1. Problem Definition

Previous project analysis was analyzed using 12.5% hurdle rate (PSC contractor guideline in proposing project). What is appropriate hurdle rate and NPV for this project?

2. Identify the Feasible Alternative

In order to calculate the PSC contractor’s hurdle rate, calculation is using following formula:

– Capital Asset Pricing Model (CAPM)

– Weighted Average Cost of Capital (WACC)

– Minimum Attractive Rate of Return (MARR)

3. Development of the Outcome for Alternative

Sources of capital alternative could be:

- Equity

- External sources of funds (lender)

4. Selection Criteria

Calculation

CAPM

WACC

MARR

5. Analysis and Comparison of the Alternative

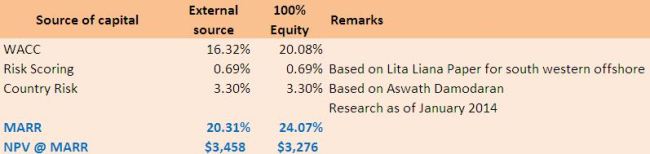

MARR calculation shows that both fund alternatives is feasible to run, this indicate by IRR > MARR, and based on risk categories MARR Standards are guided below (Sullivan, 2012:533)

This project is categorized as moderate risk (MARR < 25%).

6. Selection of the Preferred Alternative

Hurdle rate is determined by funding scheme. If using external source hurdle rate that should be applied is 20.31% (resulting NPV 3,458 MUS$), otherwise hurdle rate 24.07% should be applied for 100% equity scheme (resulting NPV 3,276 MUS$).

7. Performance Monitoring and the Post Evaluation of Result

Since economic analysis should be in real and WACC will be determine by fraction of total capital obtain by debt, range of 12.5% – 24 % hurdle rate can be applied for economic analysis. Whenever there is a change in the financing structure of the project, MARR and NPV calculation shall be performed.

Reference

- Sullivan, G. W., Wicks, M. E., &Koelling, C. P.(2012). Engineering economy 15th Edition. Chapter 13 The Weighted Average Cost of Capital (WACC), pp.525-533.

- AswathDamodaran (2014). Country Default Spreads and Risk Premiums. Retrieved from http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ctryprem.html

- AswathDamodaran (2014). Betas by Sector. Retrieved from http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/Betas.html

- Liana, Lita (2014). Using Analytical Hierarchy Process to Determine Appropriate Minimum Attractive Rate of Return for Oil and Gas Projects in Indonesia. Retrieved from http://pmworldjournal.net/article/using-analytical-hierarchy-process-determine-appropriate-minimum-attractive-rate-return-oil-gas-projects-indonesia/

- Fernandez, Pablo., Aguirreamalloa, Javier., & Linares, Pablo (2013). Market Risk Premium and Risk Free Rate used for 51 countries in 2013.Retrieved from http://papers.ssrn.com/sol3/papers.cfm?abstract_id=914160

AWESOME, Pak Andhi!! Excellent case study and you followed our step by step process perfectly. And from a technical perspective, your word count was right on the money (~250 words) and your references and citations were spot on as well.

Given you have a demonstrated a clear understanding of what I am looking for, I would really appreciate (and from a leadership perspective, give you credit) if you would mentor those on your team who are struggling with this assignment. Gideon is one of the people whose name comes to mind but I think Bu Shinta could use some tutoring as well.

Keep up the good work and I am especially pleased to see you starting to build in a “risk buffer” by getting a week or two ahead of schedule.

BR,

Dr. PDG, Jakarta

Thank you and well noted Dr. PDG.

BR,

Andhy

Pingback: W2.2_GW_ Cost of Drilling a Well | Kristal AACE 2014

Pingback: W4_AL_MIRR and PI | Kristal AACE 2014

Pingback: W5_GW_Drilling a Well Hurdle Rate | Kristal AACE 2014

Pingback: W2_IDN_Appropriate MARR for a Proposed Project | TOPAZ SMART

Pingback: W05.1_WRP_MRU Project Hurdle Rate | TOPAZ SMART

Pingback: W8_WIRA_Determine Appropriate MARR for Purpose Project Using Analytic Hierarchy Process to Determine the Risk Scoring | TOPAZ SMART

Pingback: W12_Seismic 2D Cost Evaluation | Kristal AACE 2014

Pingback: W05.1_WRP_MRU Project Hurdle Rate | GARUDA AACE 2015

Pingback: W6_WW_Field Development Project Hurdle Rate | GARUDA AACE 2015